1、 Overview of anode materials for lithium batteries

one point one Introduction to cathode materials

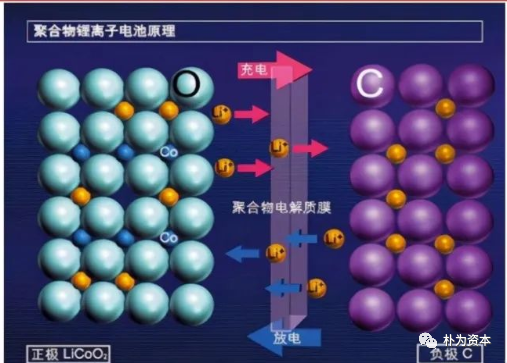

Anode material is one of the four core materials of lithium ion battery. The negative electrode of lithium battery is mainly made of carbon or non carbon materials, adhesive and additives, which are the active materials of the negative electrode. It is coated on both sides of the copper foil and then processed through drying, rolling and other processes. During the charging and discharging process of lithium battery, the lithium ion in the positive electrode will occur under the action of electrode voltage "Embedding" and "disembedding" electrochemical reactions, the negative electrode as a carrier is responsible for storing and releasing lithium ions and making the current pass through the external circuit. According to the different types and application scenarios of lithium batteries, there are also differences in the selection and cost of anode materials. On average, anode materials account for ten % ~ 15% Unequal 。

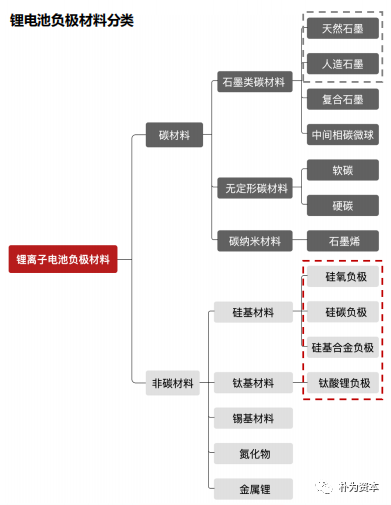

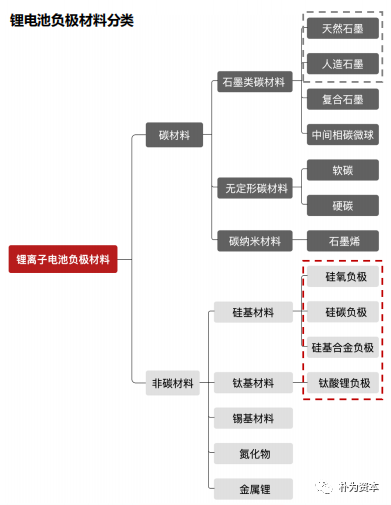

one point two Classification of anode materials: mainly artificial graphite, supplemented by natural graphite, and silicon based is the future development direction

The negative electrode of lithium battery is mainly divided into carbon materials and non carbon materials. Artificial graphite (market share reaches 84%) and natural graphite are the mainstream anode materials at present. The market share of artificial graphite has increased year by year, from 61% to 84%, while the market share of natural graphite has shrunk year by year, from 29.6% to 14%., Composite graphite and mesophase carbon microspheres are prepared by doping modification and compound treatment; Since the capacity of natural graphite and artificial graphite has been applied to the theoretical limit of materials, the new high-capacity anode materials based on silicon anode are becoming the main research and development direction, Silicon based negative electrode It will account for 1.5% in 2021.

one point three Core parameter index of cathode material

Negative electrode materials have a direct impact on the core indicators of lithium batteries, such as capacity, energy density, charging efficiency, cycle life, safety, etc. Natural graphite and artificial graphite have low cost, complete production technology and supporting facilities, high stability of graphite materials, and occupy a leading position in the anode market.

The gram capacity of negative electrode refers to the amount of electricity that can be released per gram of negative active material, which determines the specific capacity and energy density of the battery as a whole. The theoretical specific capacity of silicon based anode can reach 4200mAh/g, making it a good choice for anode materials of high energy density lithium batteries. Cycle life and safety are important indicators that demand side pays attention to. The fast charging performance and rate performance mainly refer to the ability that lithium ions can be quickly embedded and de embedded from the anode without lithium ion deposition. It also determines the charging rate of the battery and its performance at low temperature.

1.4 Artificial graphite

Artificial graphite material has high cost performance ratio. Artificial graphite has high efficiency for the first time use With the advantages of long service life, stable structure and low cost, after years of development, relevant technologies and supporting processes have become mature, and become widely used and technically mature anode materials, which is the current mainstream of the anode industry. The disadvantages are low energy density and poor processing performance. At present, most power batteries and high-end consumer batteries use artificial graphite anode materials. Compared with natural graphite, Artificial graphite It has similar specific capacity, high cycle life, excellent magnification performance, high purity, less ash, good high temperature performance, and heat conduction system It is mainly used as anode material for lithium batteries in China because of its high number and low coefficient of thermal expansion,

Artificial graphite Through coking coal, asphalt and other raw materials Crushing, granulation, graphitization and screening make 。 Among them, graphitization takes up 40% Cost, which accounts for a large proportion. Graphitization is a process that makes carbon atoms thermodynamically unstable The "two-dimensional without overlapping" arrangement is transformed into "three-dimensional orderly overlapping" arrangement, which can improve the thermal, electrical conductivity and chemical stability of products.

Graphitization is becoming increasingly important, "Integration" has become the focus of negative enterprise layout. With the expansion of negative electrode capacity And the rapid rise of graphitization processing costs Negative electrode manufacturers have increased their efforts to support graphitization.

The upstream raw materials of artificial graphite are mainly coke ( Coal series needle coal, petroleum series needle coke, petroleum coke) and asphalt, the price of coke varies greatly, which is also an important part of cost control. In general, needle coke is used as anode material with high energy density; Because of its low price, petroleum coke is often used as medium and low end anode materials. At present, the needle coke in China is mainly coal based needle coke, while oil based needle coke depends on the products from Japan Shuidao Company and the United Kingdom HSP Imported by the company. At present, the price of oil series and coal series needle coke has risen to per ton eleven thousand More than RMB, petroleum coke rises to per ton four thousand and eight hundred It is expected that the price of raw coke will continue to rise, driven by the growth of downstream demand.

Influenced by the price rise of upstream raw materials, the dual control policy of energy consumption, graphitization capacity restrictions and other factors two thousand and twenty-one Since the first quarter of, the prices of natural graphite and artificial graphite anode have risen rapidly. Low, medium and high-end natural graphite and artificial graphite anode materials have all experienced price increases to varying degrees, and the price of low-end natural graphite anode materials has changed from one point six five 10000 yuan / Tons rise to two point seven zero 10000 yuan / Tons, increased by 63.64% ; The price of low-end artificial graphite is from two point one zero 10000 yuan / Ton climbed to four 10000 yuan / Tons, up to 90.48% 。 In the downstream application field, driven by the demand for new energy power batteries, energy storage batteries and consumer batteries, battery enterprises have a strong demand for anode materials. There are many downstream manufacturers, including Yiwei Lithium Energy, Ningde Times, Xinwangda LG New energy, etc.

one point five Silicon based negative electrode - Next generation high energy density anode materials

The anode material system of lithium battery needs to be broken through urgently. According to the United States USABC Proposed two thousand and twenty-five The specific capacity of lithium battery cathode for electric vehicles needs to reach 2000mAh/g , service life at fifteen More than calendar years, and meet one thousand Cycle requirements of the week. For this development goal, the cathode of the current lithium-ion battery system has been upgraded from the early cobalt and lithium manganate to lithium iron phosphate and ternary materials, while the theoretical gram capacity of graphite for the anode material system is 372mAh/g As the industry matures, the high-end graphite is close to the theoretical capacity, and the development of new anode material system is imminent. Therefore, the major cathode taps are now laying out silicon based anode materials. Among them, Betray's shipment volume is the industry leader, and the specific capacity of the third generation silicon carbon anode products 1500mAh/g , currently under construction 4 10000 ton silicon based anode production line; The relevant materials of Shanshan Co., Ltd., Sibao Technology and other companies have also been supplied in small quantities. However, due to the high cost, currently the silicon based anode is mainly mixed with graphite anode, and the mixing ratio is 10% Within. At the application end, Panasonic, Samsung, Ningde Times and other battery manufacturers have partially adopted Betray or Shanshan and other related products. In terms of models, the application of silicon based negative electrode in some models such as Tesla Motors has been implemented, and silicon based negative electrode is expected to achieve good sales with the large-scale production of supporting models.

Silicon based anode materials are in the early stage of commercialization, and the technology is not yet mature, During charging and discharging, silicon and lithium will undergo alloying reaction, and the volume of silicon will occur 100%~300% expansion. This continuous contraction and expansion will cause cracks in the silicon anode material until it is powdered, causing rapid decline of battery capacity; Secondly, the expansion will produce great stress inside the battery, which will extrude the pole piece. With multiple cycles, the pole piece is at risk of fracture. This stress may also reduce the internal porosity of the battery, reduce the lithium ion mobile channel, cause the precipitation of lithium metal, and affect the safety of the battery.

According to the pain points of silicon based anode materials, major manufacturers have carried out technical optimization routes. From the material end, The nanocrystallization of silicon material increases the specific surface area of silicon, which cushions the pressure generated by the volume expansion of the material, thus maintaining the integrity of the active material after charging and discharging; At the same time, it can shorten the diffusion distance of lithium ion and improve the ion mobility, which is conducive to improving the magnification performance. From the structural end: surface coating, cavity construction and alloying all effectively solve the problem of silicon volume expansion. The composite modification of silicon based negative electrode improves the conductivity of silicon, strengthens the mechanical strength of materials, maintains the structural stability, and thus enhances the cycle stability.

2、 Market pattern and future prospects

2.1: The industry has developed rapidly, and the shipment of cathode materials has grown rapidly

The global production of new energy vehicles has increased significantly, and the further opening of space will drive the demand for anode materials. In 2021, the global production of new energy vehicles will reach 6.25 million, with a year-on-year growth of 112%. Looking forward to 2022, the domestic and European markets will continue to advance, and the U.S. market will expand. It is expected that the global sales of new energy vehicles will exceed 10 million in 2022. It is expected to exceed 24 million vehicles in 2025.

The shipment volume of negative electrode materials in China is determined by 52000 tons in 2014 rapidly increased to 365000 tons in 2020, with CAGR up to 38.37%; In terms of market size, the market size of anode materials has rapidly increased from 2.41 billion yuan in 2014 to 16.425 billion yuan in 2020, with a rapid growth rate. With the increase of new energy vehicle policies in various countries, the deadline for energy conservation and emission reduction is approaching, and the penetration rate of new energy vehicles is rapidly increasing, it is expected that the shipment of negative electrode materials will maintain a rapid growth in 2021. Capacity expansion continues to increase, and the capacity of the first eight companies is planned to be about 2.6 million tons. Against the background of the high increase of global power battery shipments and large-scale expansion of production, cathode material manufacturers have announced capacity plans. As of April 2022, statistics show that the planned capacity of Betray, Putai, and Shanshan, the top echelons, is higher, with 780000 tons, 350000 tons, and 680000 tons respectively; The total capacity planning of the eight leading companies in the industry has reached 2.6 million tons (including the existing capacity), more than 2.5 times of the global shipments in 2021. If other manufacturers are taken into consideration, according to Xinlun Information, the global negative electrode capacity is planned to exceed 6 million tons by 2024, and the figure calculated by Longzhong Information is about 6.44 million tons.

2.2 Competition pattern

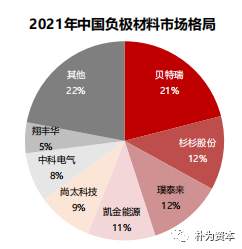

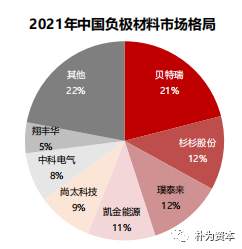

The main suppliers of negative electrode materials in China are Beterree, Ningbo Shanshan, Jiangxi Zichen, Kaijin Energy, etc. The product structure of Beterree is mainly made of natural graphite, supplemented by graphite; Jiangxi Zichen (Putai Lai) Kaijin Energy and Ningbo Shanshan are mainly made of artificial graphite. two hundred and two one year CR4 is fifty-six %The industry concentration is high.

From the price side, Putailai and Beiteri are high-end, while Zhongke Electric, Xiangfenghua and Shangtai are middle and low-end.

From the perspective of customers, Betray's customers are mainly overseas high-end power, Putai is mainly high-end consumer electronics and overseas high-end power, Zhongke Electric is overseas second line power and domestic first line power, Suntech and Kaijin Mainly relying on the growth of Ningde. All major companies in the industry have entered the supply chain of mainstream lithium battery enterprises, and have established long-term stable business cooperation relationships with downstream customers. Among them, Shanshan, Putai, Kaijin Energy, Zhongke Electric and Xiangfenghua have all entered the supply chain of Ningde Era. As the leading enterprise in the lithium battery industry, Ningde Era is expected to share the development dividend with many anode material manufacturers; Betterley is also a member of Samsung It is supplied by LG Chemical, BYD and other leading lithium battery enterprises.

two thousand and twenty In, the total capacity of several major negative electrode material manufacturers, such as Beiteri, Shanshan, and Kaijin Energy forty-nine 10000 tons, two thousand and twenty The annual industrial output is thirty-six point five 10000 tons, with sufficient capacity. two thousand and twenty-one In, the penetration rate of new energy vehicles increased significantly, and a number of negative material enterprises expanded their production on a large scale, of which Betray expanded its production twenty-seven 10000 tons, Shanshan Co., Ltd. expanded production twenty-six 10000 tons, Jiangxi Zichen and Kaijin Energy also expand production twenty 10000 tons, the expansion plan of major enterprises in the industry exceeds one hundred 10000 tons, with sufficient capacity to meet the rapidly growing demand of downstream. In terms of product price, the middle end natural graphite is affected by the decline in demand two thousand and sixteen Decline in 20% However, the price is generally stable. The price of mid end artificial graphite rises this year due to the rising demand 10.67% However, it is expected that the product price will not rise significantly in the future.

Technically, the specific capacity performance of graphite anode materials in traditional processes is gradually approaching the theoretical value. For example, the theoretical gram capacity of graphite is 372mAh/g. At present, some manufacturers' products can reach 365mAh/g, basically reaching the limit value. By taking advantage of the characteristics of the new microwave heating mode, the anode material Core indicators such as battery capacity, energy density, charging efficiency, cycle life and safety will be significantly improved, Therefore, in the case of a small technological gap, enterprises basically earn manufacturing profits, and the industry is more inclined to manufacturing attributes. The increase in profits comes from the decrease in costs. With the continuous expansion of the capacity of companies in the industry, the scale effect has brought down the cost. In 2020, the cost per ton of the major companies in the industry, Putai, Shanshan, Beiteri, Xiangfenghua, and Zhongke Electric, decreased by 24.2%, 26.6%, 16.4%, 40%, and 16.1% respectively compared with 2019. In terms of price per ton, due to the different product structures of different companies (the proportion of sales of artificial graphite and natural graphite), product performance differences (the proportion of sales of low-end, middle end and high-end anode materials), and the different structure of downstream customers (power batteries and consumer batteries), the average price of products of companies in the industry is quite different. In 2020, the average price of anode materials of Xiangfenghua will be 28600 yuan/ton, The average sales price of Putailai is 57600 yuan/ton due to a large number of consumer battery cathode materials shipped, but overall, the average sales price is in a downward phase. The single ton sales prices of Putailai, Shanshan, Beiteri, Xiangfenghua, and Zhongke Electric are 13.6%, 20.2%, 15.7%, 27.9%, and 11.4% lower than that of 2019, respectively. The decrease in the single ton cost is higher than that of the single ton sales price, which brings profit to the company.

3、 Investment analysis

With the increasing penetration rate of new energy vehicles in the world and the demand for energy storage batteries brought by the rapid growth of wind power station installation, the demand for negative electrode materials is growing rapidly, and the industry has broad space in the future. The lithium iron phosphate battery has regained the favor of domestic passenger vehicles, which will increase the unit consumption of anode materials. Scale effect and integrated layout of industrial chain have become the main ways for the anode material industry to further expand its leading edge and obtain excess earnings.

Risk warning: The opinions mentioned in this article only represent the opinions of the author